In the fast-paced world of digital finance, Bitcoin has emerged as a beacon for modern investors seeking long-term gains. This introduction casts a spotlight on the strategic approach to investing in Bitcoin, a currency that transcends traditional financial boundaries. As we embark on this journey, we unveil the allure of Bitcoin as not just a speculative asset but a viable component of a savvy investor’s portfolio.

The surge in Bitcoin’s popularity as a long-term investment has caught the attention of both seasoned and novice investors alike. This section delves into the reasons behind this growing trend, exploring how Bitcoin has evolved from an obscure digital currency to a significant player in the investment landscape. We’ll dissect the factors contributing to its increasing appeal and the shifting perspectives that have brought Bitcoin to the forefront of long-term investment discussions.

Our mission is to guide you through the intricacies of investing in Bitcoin for long-term profitability. This article aims to demystify the process, providing you with the knowledge to navigate the Bitcoin market confidently. From understanding the optimal timing for investment to mastering the art of market analysis, we cover essential strategies that align with the goals of forward-thinking investors.

The Timing of Bitcoin Investment: Identifying the Right Moment

Market Analysis for Optimal Timing

Investing in Bitcoin requires more than just a leap of faith; it demands a keen understanding of market dynamics. This section will focus on how to dissect market trends to identify the best moments to invest in Bitcoin. We will explore tools and techniques for market analysis, including chart patterns, volume analysis, and sentiment indicators. These insights will help you understand the ebb and flow of the Bitcoin market, enabling you to make informed decisions on when to enter or exit the market.

The Role of Economic Indicators

The Bitcoin market does not exist in a vacuum; it is influenced by a myriad of global economic factors. Here, we’ll unravel how economic indicators such as inflation rates, monetary policy changes, and geopolitical events can impact Bitcoin prices. Understanding these factors is crucial in predicting market movements and making strategic investment decisions. We’ll provide a breakdown of key economic indicators to watch and interpret their potential effects on the Bitcoin market.

How to Invest in Bitcoin: A Step-by-Step Guide

Setting Up Your Investment Account: Choosing the Right Platform

Investing in Bitcoin begins with selecting a cryptocurrency exchange that aligns with your investment goals and preferences. Look for an exchange with a robust security protocol, user-friendly interface, and a strong reputation in the market. Popular choices include Coinbase, Binance, and Kraken. To set up your account, follow the registration process which typically includes identity verification to comply with anti-money laundering regulations. Ensure your chosen platform operates within the legal framework of your jurisdiction.

Buying Bitcoin: Best Practices for a Smart Purchase

Once your account is set up, it’s time to buy Bitcoin. Familiarize yourself with the order types – market orders for immediate purchase at the current price and limit orders to buy at a specified price. Be mindful of transaction fees, which can vary between platforms and transaction sizes. It’s advisable to start with smaller, manageable investments, especially if you’re a novice in the cryptocurrency market. Also, keep an eye on the market trends to time your purchase effectively.

Maintaining Security in Bitcoin Transactions: Safeguarding Your Investment

Securing your Bitcoin investment is paramount. Opt for a wallet that offers robust security features – hardware wallets provide offline storage and are considered highly secure. Be cautious of phishing attacks and ensure that your investment is not vulnerable to online threats. Regularly update your wallet software, use strong, unique passwords, and consider multi-factor authentication. It’s also wise to keep a backup of your wallet’s private keys in a secure location.

Top 5 Strategies for Long-Term Bitcoin Investment

Dollar-Cost Averaging: Mitigating Market Volatility

Dollar-cost averaging involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of its price. This strategy helps in mitigating the risks associated with Bitcoin’s price volatility and can be particularly beneficial for long-term investment.

Diversifying Investment Portfolios: Balancing with Bitcoin

Incorporating Bitcoin into a diversified investment portfolio can reduce risk. While Bitcoin may be volatile, it often does not correlate directly with traditional asset classes like stocks or bonds, providing a balance in your investment portfolio.

Understanding and Leveraging Bitcoin’s Cycles: Timing Your Investment

Recognize and understand Bitcoin’s historical price cycles. While past performance is not indicative of future results, being aware of these cycles can aid in planning your long-term investment strategy and help in making informed decisions.

Staying Informed on Technological and Regulatory Developments

Bitcoin’s value can be significantly influenced by technological advancements and regulatory changes in the cryptocurrency space. Stay informed about blockchain technology developments, global regulatory shifts, and their potential impacts on Bitcoin.

Balancing Risk and Reward: Smart Risk Management

Given Bitcoin’s high volatility, it’s important to assess your risk tolerance and invest only what you can afford to lose. Managing risk while aiming for potential high rewards is crucial in Bitcoin investment.

The Timing of Bitcoin Investment: Identifying the Right Moment

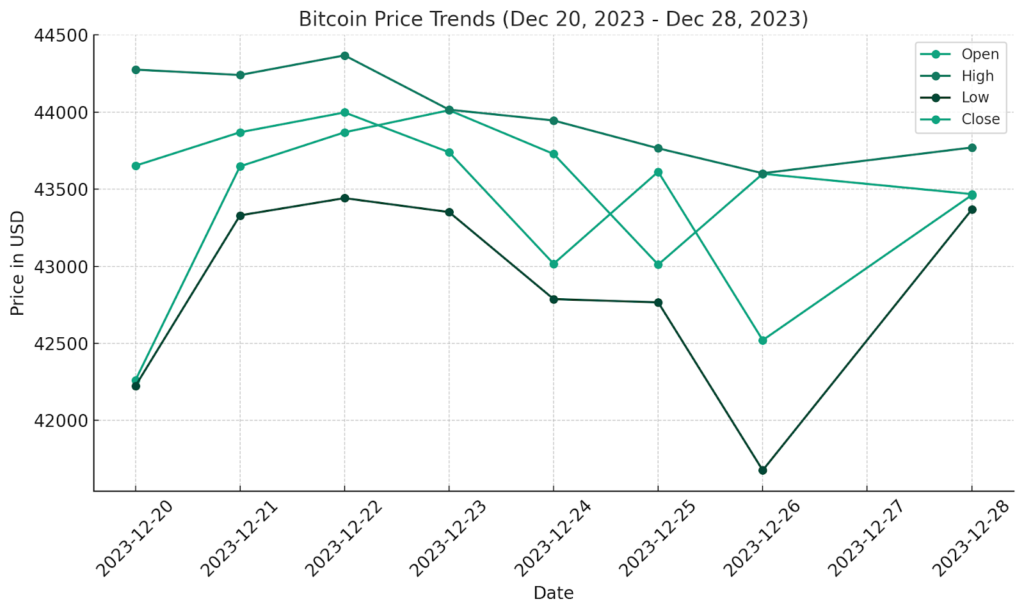

Investing in Bitcoin necessitates a nuanced understanding of its market dynamics. The recent graph (Dec 20-28, 2023) illustrates the currency’s volatility and the importance of timing. During this period, we observed fluctuations in Bitcoin’s opening, closing, high, and low prices, reflecting a market that is responsive to a variety of external factors.

For investors, these trends underscore the significance of market analysis in pinpointing the optimal moments for investment. Observing the highs and lows over a short period can provide valuable insights into potential future movements. This real-time data serves as a crucial tool for investors aiming to make informed decisions about when to enter or exit the market, aligning with the principles of strategic and informed Bitcoin investment for long-term gains.

The Long-Term Perspective of Bitcoin Investment

The Future of Bitcoin as a Store of Value

The concept of Bitcoin as a “digital gold” is gaining traction among investors. This section analyzes Bitcoin’s potential to serve as a reliable store of value over the long term, akin to gold. We examine its properties such as scarcity (limited supply), portability, and durability (digital nature), and how these contribute to its value preservation capabilities. Bitcoin’s performance during economic uncertainties and its growing acceptance among mainstream investors and institutions are also discussed to evaluate its potential as a safe-haven asset.

Bitcoin’s Evolving Role in the Global Financial System

Bitcoin’s influence on the global financial system is an unfolding narrative. This segment delves into how Bitcoin might reshape financial operations, currency systems, and economic structures. We explore its potential to facilitate cross-border transactions, provide financial services to the unbanked population, and act as an alternative to traditional banking systems. The role of blockchain technology in fostering transparency and efficiency is also discussed, highlighting Bitcoin’s impact on future financial innovations.

Challenges and Growth Prospects for Bitcoin Investors

Investing in Bitcoin is not without its challenges, including market volatility, regulatory uncertainties, and technological complexities. This part of the article explores these challenges while also highlighting the growth prospects for Bitcoin. We examine the factors driving Bitcoin’s adoption, such as increased institutional interest, advancements in blockchain technology, and the growing recognition of Bitcoin as an asset class.

Some FAQs Answered On The Relevant Topic

Is Bitcoin a Safe Investment for the Long Term?

The safety of Bitcoin as a long-term investment is a complex issue, influenced by its market volatility and regulatory environment. While its decentralized nature and potential as a store of value add to its appeal, investors should consider their risk tolerance and diversify their investment portfolios to mitigate potential risks.

How Should I Manage My Bitcoin Investments During Market Downturns?

Managing Bitcoin investments during market downturns requires a strategic approach. Investors are advised to avoid panic selling, consider long-term investment horizons, and possibly utilize dollar-cost averaging to manage their positions. Staying informed about market trends and not investing more than one can afford to lose are key strategies.

Can Bitcoin Hedge Against Inflation?

Bitcoin is increasingly considered a potential hedge against inflation. Its capped supply contrasts with the potential for unlimited fiat currency printing, making it an attractive option for investors looking to preserve value in times of inflation.

What Are the Tax Implications of Long-Term Bitcoin Investment?

The tax implications for long-term Bitcoin investments vary by jurisdiction. Typically, long-term capital gains tax applies to profits made from selling Bitcoin held for a certain period. Investors should consult tax professionals to understand specific obligations and regulations in their region.

In conclusion, this comprehensive guide has navigated the multifaceted landscape of Bitcoin investing for long-term gains. From understanding Bitcoin’s potential as a digital gold to exploring its evolving role in the global financial system, the article has provided insights into both the challenges and opportunities in Bitcoin investing. The evolving narrative of Bitcoin demands a strategic and well-informed approach from investors. As the digital currency continues to cement its position in the investment world, those who invest wisely with a long-term perspective may find Bitcoin to be a valuable addition to their portfolios. This journey into Bitcoin investment is not just about participating in a financial trend, but about understanding and leveraging a revolutionary digital asset for future profitability.

Eric Dalius is The Executive Chairman of MuzicSwipe, a music and content discovery platform designed to maximize artist discovery and optimize fan relationships. When he’s not working for MuzicSwipe, he perhaps hosting the weekly podcast “FULLSPEED,” engaging with inspiring entrepreneurs from various sectors. Additionally, through the “Eric Dalius Foundation,” he has established four scholarships for US students. Stay in touch with Eric on Twitter, Facebook, YouTube, LinkedIn, Instagram, and Entrepreneur.com.